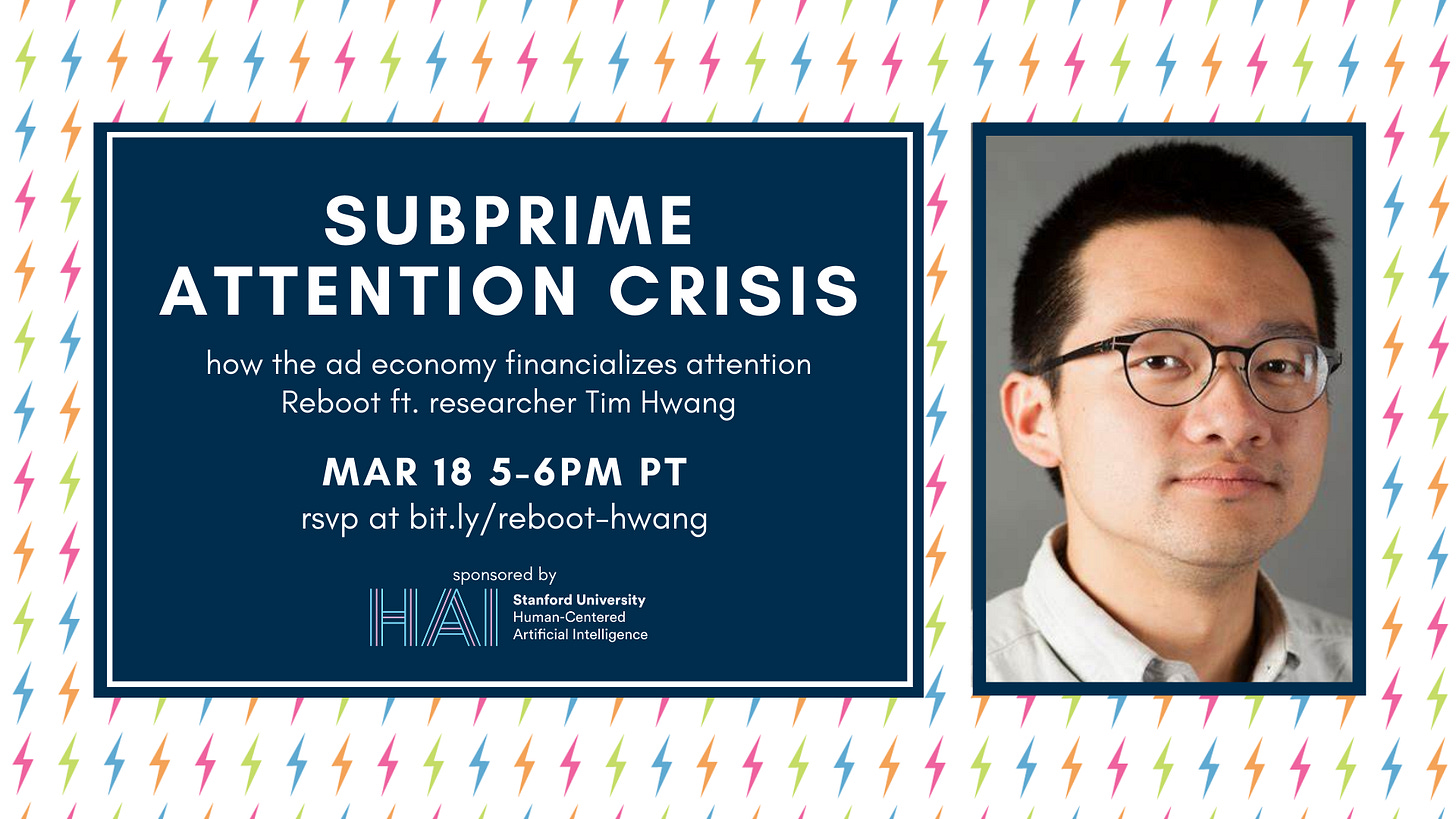

⚡ New Event: Subprime Attention Crisis ft. Tim Hwang

Writer-researcher Tim Hwang on why the ad economy might be a bubble

Hi! You’re reading Reboot, a community imagining the future of tech, humanity, and power. We share book reviews, essays, and exclusive events with authors every week.

We don’t publish platitudes on “tech for good”: rather, we believe that tech is part of a system, and ‘good’ is an action, not a belief. If you share this mission, join us:

In a shocking move, Google just announced that they'd stop selling ads based on tracking users' Chrome histories. But I couldn't help but wonder—is this a serious commitment to privacy, or just a testament that the ads aren't as profitable as they once were?

To answer that question, I turned to Reboot's next book: Subprime Attention Crisis by Tim Hwang. Not only does the book have a fittingly eye-catching cover, but I've long admired Hwang's work. From his AI policy analysis at CSET to the The California Review of Images and Mark Zuckerberg, Hwang's personal project archive is the epitome of chaotic good.

📖 subprime attention crisis by tim hwang

The book Subprime Attention Crisis poses the bold — and terrifying — possibility that the ad economy might be a bubble ready to burst. To build this argument, Tim Hwang explores the declining effectiveness and opacity in the digital ad market, then offers recommendations for taking the whole thing down.

Join us next Thursday for a Q&A on what Subprime Attention Crisis tells us about the attention economy and Big Tech's concentrated power.

🔊 our take: the internet didn't have to be like this

By Jasmine Sun

When I first heard Tim Hwang speak about Subprime Attention Crisis at Logic Book Festival, he began by saying that the problem with the discourse about Big Tech is that both its champions and its critics give it too much credit. That is, the marketers overhype what the technology can do, and the rest of us are eating it right up. (Anyone who's worked at a startup gets it: Engineering is always playing catch-up to Sales's promises.) His book, then, is a case study about why taking these claims at face value is not only gullible, but a threat to the health and stability of our digital economy.

Hwang argues that the modern digital ad market is on its way to becoming a bubble, much like the subprime mortgage crisis in 2008. Today, consumers ignore ads, Facebook and Google hide behind opaque, self-serving definitions of "views" and "conversions," and everything from overt fraud (click farms) to clever accounting (Facebook's overstatement of video views) runs rampant. It feels like everyone, from the digital marketers to the industry researchers, has a perverse incentive to act like digital ads work better than they do, despite study after peer-reviewed study questioning this assumption.

Hwang is also a fantastic econ teacher—and I'm saying this as someone who had no idea how the 2008 financial crisis worked until last summer. He breaks down the programmatic ad market step by step, walks you through its similarities to the mortgage market of the late aughts, then provides numbered suggestions to reform the system—all in a tight little 178-page volume. With clever analogies (e.g. one unit of attention: one fictionalized Standardized Chicken Lot) and a clear-cut narrative structure, you won't need a pre-existing passion for two-sided market design to get something out of this read.

By the end of the book, Hwang starts describing the social consequences of having the whole Internet—from journalism to Google Maps—run on ad dollars: surveillance capitalism, addictive feeds, political polarization. Each of his carefully numbered arguments builds toward a picture of the ad industry as an increasingly precarious house of cards, so it's no surprise that he concludes that "Rather than trying to fix a broken market, we should work toward a controlled demolition that reduces its influence in the long run." Hwang ends by proposing a few of these possible reforms, such as industry-independent research organizations, mandatory disclosures for vendors of programmatic ads, and legal teeth to punish frauds.

Overall, I found Subprime Attention Crisis persuasive, if mildly hyperbolic: the narrow reforms proposed in the last few pages don't seem to match the urgency of the the crisis-like descriptions of the first three-quarters. In my opinion, the bigger challenge of the next 5 or 10 years—and what I'm most interested in asking Hwang about next Thursday—is how we'll actually wean the web off ads and toward something more sustainable.

🌀 microdoses

📺 If you prefer audio, the Freakonomics podcast did a two-part series questioning the effectiveness of modern advertising: TV and digital. (Tim Hwang is a guest on the latter!)

🔢 The latest newsletter from Exponential View dives deep into the broader political and economic implications of the data economy, including this podcast on surveillance capitalism and tips on how you can sabotage Big Brother.

🐈 Can cats eat blueberries? This whimsically written article explores how SEO has made online content bad and boring.

🗒️ An essay-writing tip from Tressie McMillan Cottom, one of my favorite writers: read around your subject, not just about it.

☁️ How to do something to do nothing

🚀 New Reboot mission statement?

💝 a closing note

I asked the fellowship: How do you feel about targeted ads? Do you click on them?

Jet (fellow, Yale-NUS 2024): I worked as a growth intern at a startup, and my scope was to put up ads and adjust to those analytics. I learned that audiences are desensitized to online experiences including ads, which embody an alienation from real-life engagement. Personally, though, I see ads as a form of tax whose presence I accept and don’t invest much energy in.

Matthew (mentor, Princeton PhD candidate): The targeted ads I get on Instagram feel scarily good, but I try very hard not to purchase anything from ads and generally use adblockers / prefer to pay subscriptions rather than with my personal data. I'm also of the opinion (that I think Tim Hwang shares) that the entire ad industry is built on an unprovable assumption that vacuuming personal data is necessary or justifiable.

Attentively,

—Jasmine & Reboot team